Description of the Delta module

The Delta Cryptovizor module consists of several blocks: TradingView chart, Markets Volume block, filter by date and Overall volume.

1. TradingView Chart

The block has all the basic TradingView functionality.

On the panel on the left you can see the drawing tools, they are divided into subgroups depending on the type of tool.

In addition, you can easily adjust the width of the chart window. Drag the graph and block separator on the right.

This block contains the following buttons:

Timeframe switching

Selection of the type of data display on the chart (candlesticks, bars, linear, area, and so on)

Adding basic indicators, including the visible area volume profile.

Volume profile visible range (VPVR) is an indicator that displays trading activity for a specified period of time at certain price levels. The indicator builds a histogram on the chart, taking into account such user parameters as the number of lines and the time period. This histogram reflects the dominant or significant price levels based on volume. Essentially, a volume profile takes the total volume traded at a certain price level over a specified time period, divides that total volume by the buying or selling volume, and then provides that information to the trader.

Point of Control (POC) is the price level over a period of time with the highest trading volume.

The ticker allows you to switch between trading pairs within the selected exchange.

Ticker is the short name of the coin listed on the exchange. It is a unique identifier within the exchange or information system.

All your markup for each exchange or selected trading pair will be saved automatically. Autosave of markup on the chart is done every 5 seconds.

You can share screenshots of your chart.

The data is displayed for the UTC time zone used by the exchanges. The current UTC time is shown on the bottom line below the TradingView block. If you wish, you can change the time zone to a convenient one by clicking on the settings icon near the clock. To change the zone, you need to go to the settings, select the Tool section and the Time zone item.

2. Markets volume block

This block provides cumulative information for each exchange, taking into account all trading pairs. It displays the information of the current candle of the selected timeframe, which is indicated in the upper right corner.

OVERALL is a chart of the average exchange rate of bitcoin against the dollar and USDT. It is also the total delta and the volume of all trading pairs of the presented exchanges. All this is in one place..

Clicking on the name of the exchange in the MARKET column allows you to open a graph of available BTC to USDT trading pairs on this exchange.

DELTA BTC column displays the difference between filled market buy and sell orders in stablecoins and USD.

VOLUME column displays the trading volume in stablecoins and USD.

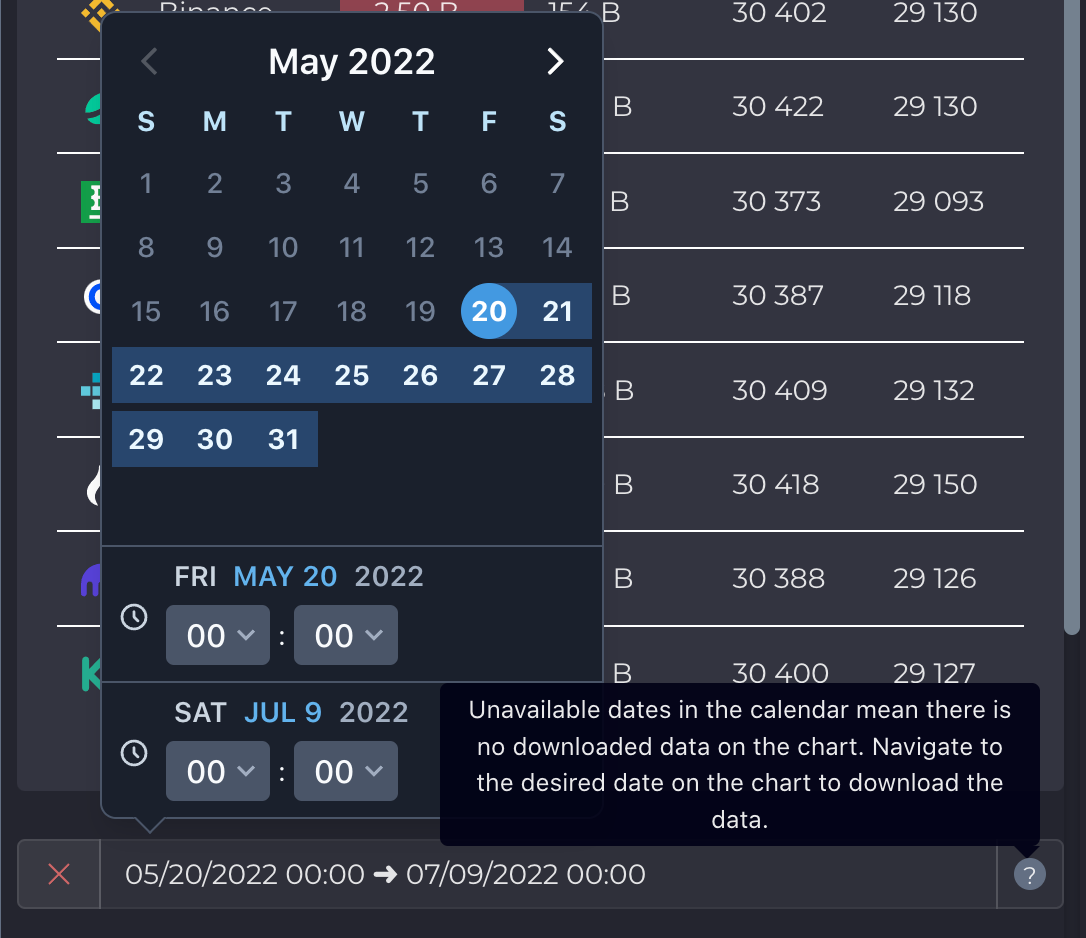

3. Filter by date

You can set the required time range for the Markets Volume block. This will allow you to find out the cumulative delta and trading volume for all exchanges together and for each separately.

4. Overall volume

This block displays detailed information on each candlestick of an open chart.

5. Navigation

If this function is active, when clicking on a candle on the chart, the line corresponding to the selected candle will be highlighted in the Overall Volume block.

Press the up button to quickly return to the top of the list.

6. Indicators of trading volume, cumulative delta and delta volume

The trading volume indicator and the TradingView delta indicator correspond to the data of the Overall Volume block. All calculations are made in USDT and USD.

Delta volume is the difference between market buys and retail sales at each price, in each candle or bar.

The TradingView cumulative delta indicator helps you quickly determine the state of supply and demand for a selected period of time.

In the case of an increase in the cumulative delta, market orders to buy will prevail, filling someone's limit sells. In the case of an increase in the cumulative delta, market orders to buy will prevail, filling someone's limit sells. And if the cumulative delta decreases, limit buy orders are filled in the market by selling.

Last updated